aivixprel.online

News

Van Eck Oih

What was OIH's price range in the past 12 months? OIH lowest ETF price was $ and its highest was $ in the past 12 months. Latest VanEck Oil Services ETF (OIH:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. VanEck Oil Services ETF (OIH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Oil. VanEck ETF Trust - VanEck Oil Services ETF is an exchange traded fund launched and managed by Van Eck Associates Corporation. It invests in public equity. Performance charts for Vaneck Oil Services UCITS ETF (OIH - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. OIH - VanEck ETF Trust - VanEck Oil Services ETF (ARCA) - Share Price and News. VanEck Oil Services ETF (OIH) · Top 10 Holdings (% of Total Assets) · Sector Weightings · Overall Portfolio Composition (%) · Equity Holdings · Bond. View the latest VanEck Oil Services ETF (OIH) stock price and news, and other vital information for better exchange traded fund investing. OIH Analysis & Insights. OIH tracks a market-cap-weighted index of 25 of the largest US-listed, publicly traded oil services companies. What was OIH's price range in the past 12 months? OIH lowest ETF price was $ and its highest was $ in the past 12 months. Latest VanEck Oil Services ETF (OIH:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. VanEck Oil Services ETF (OIH®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Oil. VanEck ETF Trust - VanEck Oil Services ETF is an exchange traded fund launched and managed by Van Eck Associates Corporation. It invests in public equity. Performance charts for Vaneck Oil Services UCITS ETF (OIH - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. OIH - VanEck ETF Trust - VanEck Oil Services ETF (ARCA) - Share Price and News. VanEck Oil Services ETF (OIH) · Top 10 Holdings (% of Total Assets) · Sector Weightings · Overall Portfolio Composition (%) · Equity Holdings · Bond. View the latest VanEck Oil Services ETF (OIH) stock price and news, and other vital information for better exchange traded fund investing. OIH Analysis & Insights. OIH tracks a market-cap-weighted index of 25 of the largest US-listed, publicly traded oil services companies.

Vaneck Oil Services ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Get comprehensive information about VanEck Oil Services ETF (USD) (USH) - quotes, charts, historical data, and more for informed investment. The fund is subject to equity market risk as well as concentration risk, as the index contains fewer stocks than a broad market index fund. When OIH. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for VanEck Oil Services ETF (OIH). Gain valuable insights from earnings call. OIH | A complete VanEck Oil Services ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Latest VanEck Oil Services ETF (OIH) stock price, holdings, dividend yield, charts and performance. OIH Price - See what it cost to invest in the VanEck Oil Services ETF fund and uncover hidden expenses to decide if this is the best investment for you. Get the latest VanEck Oil Services ETF (OIH) real-time quote, historical performance, charts, and other financial information to help you make more informed. OIH - VanEck Oil Services ETF - Stock screener for investors and traders, financial visualizations. VanEck Oil Services ETF OIH has $ BILLION invested in fossil fuels, 99% of the fund. The Fund seeks to replicate the price and yield performance of the Market Vectors US Listed Oil Services 25 Index. The Index is comprised of common stocks and. An easy way to get VanEck Oil Services ETF real-time prices. View live OIH stock fund chart, financials, and market news. OIH Oil Services ETF · REMX Rare Earth and Strategic Metals ETF · SLX Steel ETF The principal risks of investing in VanEck ETFs include sector, market. VanEck Oil Services ETF (OIH) is a passively managed Sector Equity Equity Energy exchange-traded fund (ETF). VanEck launched the ETF in The investment. In depth view into OIH (VanEck Oil Services ETF) including performance, dividend history, holdings and portfolio stats. Performance charts for VanEck Oil Services ETF (OIH - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Get the latest VanEck Oil Services ETF (OIH) fund price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Find the latest quotes for VanEck Oil Services ETF (OIH) as well as ETF details, charts and news at aivixprel.online Assess the OIH stock price quote today as well as the premarket and after hours trading prices. What Is the VanEck Vectors Oil Services Ticker Symbol? OIH is. About VanEck Vectors Oil Services ETF (OIH). OIH tracks a market-cap-weighted index of 25 of the largest US-listed, publicly traded oil services companies.

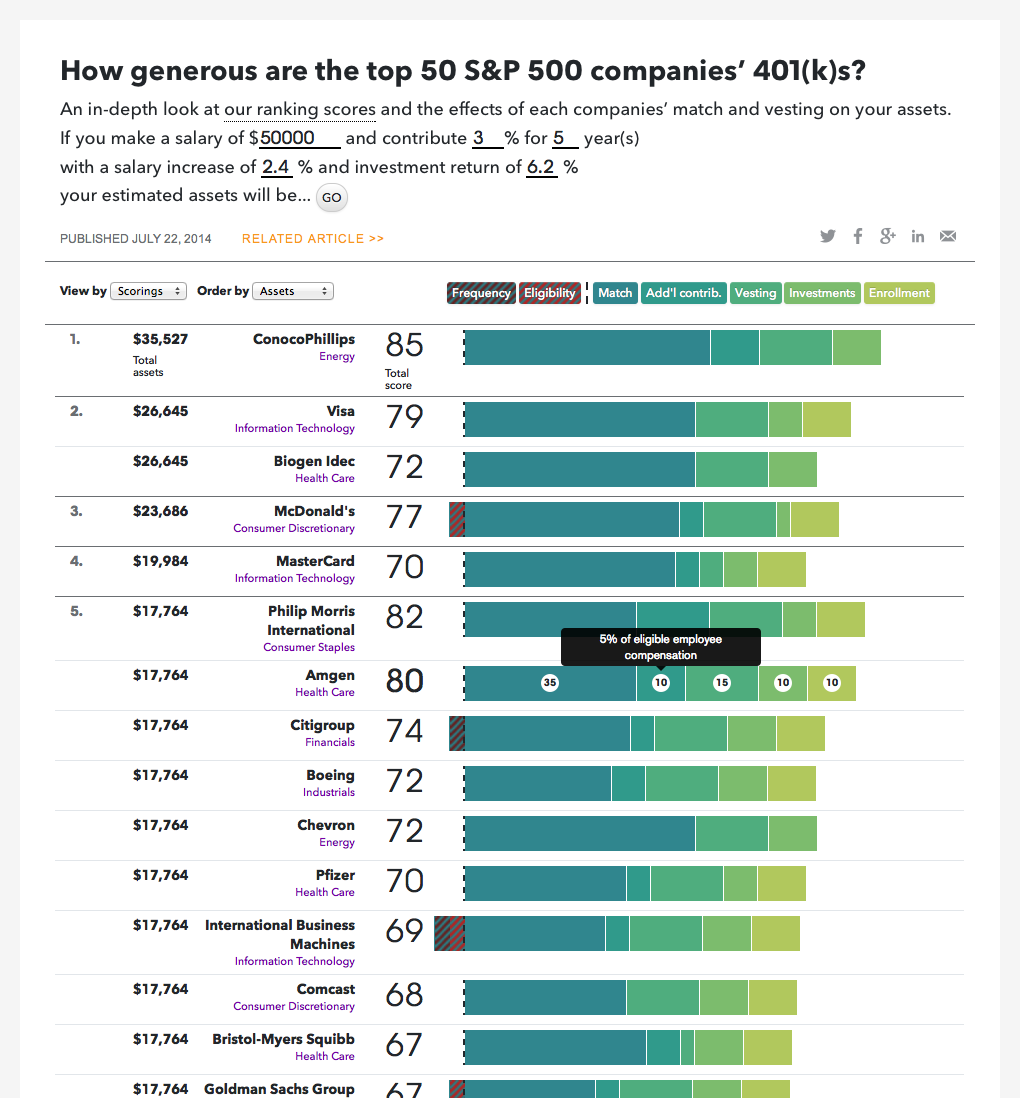

Best 401 K Match

Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. PlanPro's first annual (k) state trends report analyzes (k) trends including participation rates, auto-enrollment and employer contribution coverage. The best one that I've heard of is Delta Airlines (and the other major airlines) does a direct contribution of 18% to the k (at least for. In either case, you will be bound by the terms of the plan document. Once you have decided on a (k) plan, you will need to choose the type of plan best for. This percentage, combined with a % match from an employer, means an employee could save % of their total salary (pre-tax) in their (k) plan. So, if. Example of a full match: % of what you contribute up to 6% of your salary. In this scenario, if you earn $, per year and contribute 6% of your salary. Generous Employer (k) Matches · Boeing. · Charles Schwab. · Citigroup. · Comcast. · Honeywell International. · Qualcomm. · Southwest Airlines. (k) Providers ; GO · · 28 ; Fidelity Investments · · 69, ; Vanguard · · 22, ; T. Rowe Price · · 7, ; Charles Schwab · · 26, The most common (k) match formula on plans at Fidelity is a dollar-for-dollar match on the first 3% and then 50 cents on the dollar on the next 2%, according. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. PlanPro's first annual (k) state trends report analyzes (k) trends including participation rates, auto-enrollment and employer contribution coverage. The best one that I've heard of is Delta Airlines (and the other major airlines) does a direct contribution of 18% to the k (at least for. In either case, you will be bound by the terms of the plan document. Once you have decided on a (k) plan, you will need to choose the type of plan best for. This percentage, combined with a % match from an employer, means an employee could save % of their total salary (pre-tax) in their (k) plan. So, if. Example of a full match: % of what you contribute up to 6% of your salary. In this scenario, if you earn $, per year and contribute 6% of your salary. Generous Employer (k) Matches · Boeing. · Charles Schwab. · Citigroup. · Comcast. · Honeywell International. · Qualcomm. · Southwest Airlines. (k) Providers ; GO · · 28 ; Fidelity Investments · · 69, ; Vanguard · · 22, ; T. Rowe Price · · 7, ; Charles Schwab · · 26, The most common (k) match formula on plans at Fidelity is a dollar-for-dollar match on the first 3% and then 50 cents on the dollar on the next 2%, according.

ShareBuilder k is an online-only workplace retirement plan provider. You can quickly register your business for a (k) plan on their website. Most (k) plans set limits for employer matching—you might offer to match contributions up to 6% of the employee's salary, for example. SEP IRAs and SIMPLE IRAs are generally good starting points to consider for small businesses, but (k) plans may offer greater choices in plan design. The. Among the best-known and most popular company-sponsored retirement plans, a (k) gives employers flexibility in plan features and design, has high. Apple k match. Apple is one of the top employers with the best (k) matching contributions for employees. Apple matches 50% of the first 6% of eligible. Employer match: This refers to the amount your employer puts in your (k) in addition to your contribution. It can range from 0% to %, and typically. Benefits Administration Made Easy With Paychex · Find the Best Retirement Plan Option for You · SECURE Act Can Help You Save · Retirement Savings Requirements. According to research by consultancy Aon Hewitt, referenced in the report, 92 percent of employers with (k) plans match employees' (k) contributions, with. Employer contributions are required for safe harbor (k) plans. As the employer, you must match either 4% for participating employees or 3% for all eligible. For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're just. Hospital Corporation of America K program background (source): HCA Healthcare offers a % match on your (k) contributions, up to 9% of pay based on. 1. Vanguard. The Details: According to its Glassdoor profile, Vanguard offers a k plan that one employee says has a generous match. · 2. GoFundMe · 3. What Is a Good K Match? The majority of companies offer some sort of matching contribution for an average of % of a person's pay, but there are many. That means the more money you contribute each pay period, the more of a match you get. Matching formulas vary from company to company. Many employers offer a This article delves into the intricacies of these plans, highlighting some companies with the best (k) match offerings and providing insights into how. It is my opinion: Good: 1–2% at 25% matching (me) Very Good: 3–4% at 50% matching Outstanding: 5–6% at % matching, generally with limits. For example, let's assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your (k). If you have an annual. Contributions to an Individual (k) can be higher than contributions to other types of retirement plans. You can fund your account as both the employer and. If you contribute a specific percentage of your income into your employer's (k) plan, your employer will match that contribution. Typically, employer. ABK vs Typical (k) Plan ; ELIMINATE COMMISSIONS (12b1 FEES AND SUB-TA FEES), YOU BET! NEVER ; ELIMINATE THE INCLUSION OF PROPRIETARY FUNDS, OF COURSE! NO WAY.

Best Rated Dividend Mutual Funds

LIC MFDividend Yield Fund Direct Growth Fund Performance: The LIC MFDividend Yield Fund has given % annualized returns in the past three years and %. Hartford Quality Value ETF, QUVU. Morningstar Ratings (Mutual Fund I-Shares) for Select Hartford Funds that Invest in Dividend-Paying Stocks. Hartford Balanced. *Standard online $0 commission does not apply to over-the-counter (OTC) equities, transaction-fee mutual funds, futures, fixed-income investments, or trades. Also available as an Admiral™ Shares mutual fund. Buy Compare. Top 5 Dividend Yield Mutual Funds to Invest in · Templeton India Equity Income Fund · ICICI Dividend Yield Equity Fund · Sundaram Dividend Yield Fund · UTI Dividend. The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts. Top Highest Dividend Yield ETFs ; NVDQ · T-Rex 2X Inverse NVIDIA Daily Target ETF, % ; OARK · YieldMax Innovation Option Income Strategy ETF, %. Dividend Yield Funds focus on established, dividend-paying companies, making them suited for conservative investors. Dividend payments indicate stability, thus. Here are our favorite dividend-stock mutual funds—two index funds and five actively managed portfolios. LIC MFDividend Yield Fund Direct Growth Fund Performance: The LIC MFDividend Yield Fund has given % annualized returns in the past three years and %. Hartford Quality Value ETF, QUVU. Morningstar Ratings (Mutual Fund I-Shares) for Select Hartford Funds that Invest in Dividend-Paying Stocks. Hartford Balanced. *Standard online $0 commission does not apply to over-the-counter (OTC) equities, transaction-fee mutual funds, futures, fixed-income investments, or trades. Also available as an Admiral™ Shares mutual fund. Buy Compare. Top 5 Dividend Yield Mutual Funds to Invest in · Templeton India Equity Income Fund · ICICI Dividend Yield Equity Fund · Sundaram Dividend Yield Fund · UTI Dividend. The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts. Top Highest Dividend Yield ETFs ; NVDQ · T-Rex 2X Inverse NVIDIA Daily Target ETF, % ; OARK · YieldMax Innovation Option Income Strategy ETF, %. Dividend Yield Funds focus on established, dividend-paying companies, making them suited for conservative investors. Dividend payments indicate stability, thus. Here are our favorite dividend-stock mutual funds—two index funds and five actively managed portfolios.

Popular Dividend Yield Funds ; Templeton India Equity Income Fund – Direct Growth · ₹2,; ; ICICI Pru Dividend Yield Equity Fund – Direct Growth · ₹4, Best 3-Month Return Over the Last 3 Years. 3 months ending Jan 31, Overall Morningstar Rating for Equity Dividend Fund, as of Aug 31, Beyond individual stocks, there are numerous exchange-traded funds, index funds and mutual funds to explore. Some emphasize dividend yield; others focus on. *The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts. Dividend Funds ; First Trust Portfolios L.P - First Trust Corporate High Income 24 Fd USD MNT CASH. FCMWBX · $ % · % ; Advisors Asset Management. Month Dividend Yield is a financial ratio that shows how much a mutual fund pays out in dividends each year relative to its value with maximum sales charges. Schwab Dividend Equity Fund. Type: Mutual Funds. Symbol: SWDSX. Net Expense Ratio: %. Summary Objective: The fund seeks current income and capital. Highest Dividend Paying Funds ; Axis Flexi Cap Reg IDCW · AxisMF, ; Period Range To ; Dividend History View ; Canara Robeco Flexi. The best global dividend ETF by 1-year fund return as of ; 1, Franklin Global Quality Dividend UCITS ETF, +% ; 2, iShares MSCI World Quality. FUND. Fidelity® Strategic Dividend & Income® Fund. %, % ; PRIMARY BENCHMARK. S&P Close. %, % ; SECONDARY BENCHMARK. FID Strat D & I Comp. FZILX has a dividend yield currently of %, and a 0% expense ratio for ex-US investment, which is quite the low cost feat. Bogleheads love. Top schemes of Dividend Yield Mutual Funds sorted by Returns ; ICICI Prudential Dividend Yield Equity Fund. #2 of 6 ; Franklin Templeton. Templeton India Equity. Equity: Thematic-Dividend Yield ; ABSL Dividend Yield Dir · % ; Baroda BNP Paribas Dividend Yield Dir · -- ; HDFC Dividend Yield Dir · % ; ICICI Pru Dividend. Best 3-Month Return Over the Last 3 Years. 3 months ending Jan 31, Overall Morningstar Rating for Equity Dividend Fund, as of Aug 31, The fund seeks dividend income and long-term capital growth primarily through investments in stocks. US Mutual Fund Vendor Indices Disclaimers. High Yield Dividend Income Ind. Advisor Instl. Get the lastest fund and ETF news in your inbox each week. Receive latest news, trending tickers, top stocks. The Morningstar Rating™ for funds, or "star rating", is calculated for funds with at least a three-year history. Exchange-traded funds and open-ended mutual. 5 Years, ; 10 Years, ; The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds and exchange-. Exchange Traded Funds (ETFs) may not be marketed or advertised as an open-end investment company or mutual fund. The Morningstar RatingTM for funds, or "star. The fund seeks dividend income and long-term capital growth primarily through investments in stocks. US Mutual Fund Vendor Indices Disclaimers.

Can You Cash Out Stocks On Cash App

Sending stock · Enter the amount, in USD, of stock you would like to send · Enter the recipient's $cashtag and select “send as” Stock · Search for the stock or. If you sell your free stock before the 30 days, you won't be able to access those funds in your withdrawable cash. After the day window, there are no. Once the account sponsor approves the sponsored person's request to invest in stocks and bitcoin, the sponsored person can start buying stocks in Cash App. Please note that there's a mandatory two business day holding period after the sale before your cash will be available to use. Follow these steps to sell an. In this short video, we'll show you how to trade stock using the E*TRADE app. When you're ready to buy (or sell) a stock, it's time to fill out the trade. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. I transferred all my full stocks to robinhood last month but my partial shares in stocks are like $ leftover on cashapp they didn't let. I am trying to sell my stocks and I just get "We ran into a hiccup. please try again later." This has been happening for a few days. Sending stock · Enter the amount, in USD, of stock you would like to send · Enter the recipient's $cashtag and select “send as” Stock · Search for the stock or. If you sell your free stock before the 30 days, you won't be able to access those funds in your withdrawable cash. After the day window, there are no. Once the account sponsor approves the sponsored person's request to invest in stocks and bitcoin, the sponsored person can start buying stocks in Cash App. Please note that there's a mandatory two business day holding period after the sale before your cash will be available to use. Follow these steps to sell an. In this short video, we'll show you how to trade stock using the E*TRADE app. When you're ready to buy (or sell) a stock, it's time to fill out the trade. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. I transferred all my full stocks to robinhood last month but my partial shares in stocks are like $ leftover on cashapp they didn't let. I am trying to sell my stocks and I just get "We ran into a hiccup. please try again later." This has been happening for a few days.

When you buy stock using Cash App Investing, you are limited to 3 day trades within a rolling 5 day trading period. For example: On Monday, you buy and sell ABC. Whether you're new to investing or already have a portfolio, Cash App provides brokerage services, allowing you to buy, trade, and sell stocks and exchange-. You can withdraw the money you have invested in stock markets anytime as no rules are preventing you from it. However, there are fee, commissions and costs. Tap the Investing tab on your Cash App home screen · Tap the search bar and enter a company name or ticker symbol · Select the company whose stock you want to buy. Cash App doesn't currently allow directly transferring stocks to a bank account. However, you can achieve this by selling your stocks on Cash. Login to the Stash app. · Tap Transfer at the bottom of the screen. · Select the accounts you want to move money from and to. · Enter the amount you want to. Tap the Investment tab on your Cash App home screen; Scroll down to Stocks Owned; Press the percentage change next to a stock that you own; Select an option. If. To transfer your stock from Cash App Investing to an external brokerage account, you are required to use the Automated Customer Account Transfer Service, or. Robinhood: Mobile app and trading platforms. If you're looking for a user-friendly way to buy and sell stocks, you'll find that both platforms excel. Able to pay my friends and family quickly, I would say the only time I had a bad experience is when someone got my card and cashapp did not refund my money. How do I cash out my stocks? You can cash out your stocks by selling them. To sell stocks through Cash App, follow the steps listed above. After you've cashed. After you get the hang of the investing process through Cash App, you may want to move on to a dedicated brokerage account. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Some brokerages do not allow the purchase of fractional shares. At least with CashApp you can buy a tiny piece of Berkshire Hathaway and. We'll lead you through every step of the procedure in this tutorial, so you may confidently sell your stocks and keep track of your profits. If you own shares of a stock or ETF that is no longer offered on Cash App, you'll be able to view them in your portfolio and sell them, but you'll be unable to. How to Sell Stocks · Go to your Invest tab and select Stocks · Select any of your stock investments and tap Sell · Enter an amount and tap Next · Reconfirm. You can make money on Cash App stocks. Investors can buy and hold or sell stocks once they reach optimal exit prices. Q. How long does it take. Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into. Hey, Stock can be purchased using the funds in your Cash App balance. · Once the order is filled, you can view your investment by tapping the.

Esop Fund

When they retire or leave the company, the business buys back the shares, helping fund their retirement. "An ESOP may provide business owners with an. The shares purchased with the borrowed funds are placed in a suspense ESOP loan and that ESOP financing involves transferring employer stock to the ESOP. In the simplest terms, an Employee Stock Ownership Plan (ESOP) is a retirement plan. But, in reality, it is much more than that: ESOPs motivate employees. Rather, their shares of company stock are earned over time. After an ESOP trust is established, the company uses funds that would typically go toward income tax. fund the plan. Payback of the loan occurs with shares from the plan.. ESOP Trust—This is a trust that companies might choose to set up for their employees. ESOP (Employee Stock Ownership Plans) and a Self-Directed IRA and K. This An employer will set up a trust fund where the goal is to share their. Creating an ESOP is an exit strategy for many professionals. ESOP financing may require obtaining both senior and subordinate debt. An ESOP is leveraged if it borrows money to purchase shares of the company's stock. The loan may be from a financial institution, or the selling shareholder may. The Wells Fargo ESOP Fund strives to provide investors with long-term growth of capital; however, there is no assurance that this objective will be attained. When they retire or leave the company, the business buys back the shares, helping fund their retirement. "An ESOP may provide business owners with an. The shares purchased with the borrowed funds are placed in a suspense ESOP loan and that ESOP financing involves transferring employer stock to the ESOP. In the simplest terms, an Employee Stock Ownership Plan (ESOP) is a retirement plan. But, in reality, it is much more than that: ESOPs motivate employees. Rather, their shares of company stock are earned over time. After an ESOP trust is established, the company uses funds that would typically go toward income tax. fund the plan. Payback of the loan occurs with shares from the plan.. ESOP Trust—This is a trust that companies might choose to set up for their employees. ESOP (Employee Stock Ownership Plans) and a Self-Directed IRA and K. This An employer will set up a trust fund where the goal is to share their. Creating an ESOP is an exit strategy for many professionals. ESOP financing may require obtaining both senior and subordinate debt. An ESOP is leveraged if it borrows money to purchase shares of the company's stock. The loan may be from a financial institution, or the selling shareholder may. The Wells Fargo ESOP Fund strives to provide investors with long-term growth of capital; however, there is no assurance that this objective will be attained.

ESOPs are a highly-tax-favored way for employees to share ownership in their company through a trust fund. Companies make tax-deductible contributions to the. shows how an ESOP works in one typical case: a privately held C corporation. The company creates the ESOP and its trust, the company funds the trust, the trust. ESOP Fund means the portion of the Trust Fund consisting of assets allocated to all Participants' ESOP Accounts, unallocated assets representing contributions. Here are seven key points on how ESOPs work: ESOPs are highly tax-favored way for employees to share ownership in their company through a trust fund. Companies. How ESOPs Work Companies set up a trust fund for employees and contribute either cash to buy company stock, contribute shares directly to the plan, or have. While these plans are covered by many of the same rules and regulations that apply to (k) plans, an ESOP uses a different approach to help employees fund. An employee stock ownership plan (ESOP) is a retirement plan in which an Fund Analyzer · Retirement Ballpark E$timate · Social Security Retirement. Instead, the company fully funds the benefit. Becoming a partial owner of the company you work for can be financially and personally rewarding. But if an ESOP. When an ESOP borrows money to buy company shares, it is called a leveraged ESOP. The ESOP may own any percentage of the company's shares, and shares may come. An ESOP empowers a business owner to sell all or a portion of a company to his or her employees to generate funds for expansion, to fuel operations or to. The (k) Plan uses one or more third party brokers to conduct transactions related to WFC Common Stock in the Wells Fargo ESOP Fund. Principal investment. ESOPs. Employees may need to wait for funds. It takes time to dispose of stock. When employees leave an ESOP company, the plan may. From Chapter 2, "Types of ESOPs and Their Financing". An ESOP may be funded either with a loan (a “leveraged ESOP”) or with discretionary contributions (a “. ESOP Advantages in Corporate Financing. To fund an ESOP's purchase of stock from existing shareholders or subscribe to new shares of company stock (raising new. Most private US companies operating as an ESOP are structured as S corporation ESOPs (S ESOPs). fund repurchase when employees retire. It is the. An ESOP can also help a young entrepreneur sell an existing business so they can use the liquidity to fund their next business move. Know your options. We. ESOP is a qualified defined contribution plan like a (k). However, the plan contains company stock — employees contribute none of their own funds to the plan. Hedge Fund. FP&A. FP&A. Business Intelligence · Data Science Analyst. Wealth What is an Employee Stock Ownership Plan (ESOP)?. How an ESOP Works; Benefits of. A leveraged employee stock ownership plan (LESOP) uses borrowed money to fund an ESOP as a form of equity compensation for company employees. In most cases, the company funds the ESOP, with employees paying nothing to participate in the company's ESOP. However, some companies may have other.

Emini Charts

S&P E-mini daily price charts for the futures contract. See TradingCharts for many more commodity/futures quotes, charts and news. View the latest E-Mini S&P Future Continuous Contract Stock (ES00) stock price, news, historical charts, analyst ratings and financial information from. With ES futures, you can take positions on S&P performance electronically. Capitalize on the around-the-clock liquidity of E-mini S&P futures. index closed at 2,, making each E-mini contract a $, bet. External links. edit · E-mini S&P Futures: CME description · Quotes, E-mini S&P Price Action Indicators used on the chart: Day Trading S/R Pro Reversal Signal Bars Support and Resistance – Double Bottom /Top. Get a free day trial to Real Time Futures Trading Charts, commodity futures trading charts & quotes with streaming data and over 60 trading indicators. In. The current price of Micro E-mini S&P Index Futures is 5, USD — it has risen % in the past 24 hours. Watch Micro E-mini S&P Index Futures. By following a few simple steps, you can build a fully customized E-mini futures chart that's specifically designed to complement your trading strategy. Technical futures chart with latest price quote for S&P E-Mini, with technical analysis, latest news, and opinions. S&P E-mini daily price charts for the futures contract. See TradingCharts for many more commodity/futures quotes, charts and news. View the latest E-Mini S&P Future Continuous Contract Stock (ES00) stock price, news, historical charts, analyst ratings and financial information from. With ES futures, you can take positions on S&P performance electronically. Capitalize on the around-the-clock liquidity of E-mini S&P futures. index closed at 2,, making each E-mini contract a $, bet. External links. edit · E-mini S&P Futures: CME description · Quotes, E-mini S&P Price Action Indicators used on the chart: Day Trading S/R Pro Reversal Signal Bars Support and Resistance – Double Bottom /Top. Get a free day trial to Real Time Futures Trading Charts, commodity futures trading charts & quotes with streaming data and over 60 trading indicators. In. The current price of Micro E-mini S&P Index Futures is 5, USD — it has risen % in the past 24 hours. Watch Micro E-mini S&P Index Futures. By following a few simple steps, you can build a fully customized E-mini futures chart that's specifically designed to complement your trading strategy. Technical futures chart with latest price quote for S&P E-Mini, with technical analysis, latest news, and opinions.

E-Mini S&P futures quotes, and other specialized tools. Why trade E-mini S&P futures? Why consider trading E-mini S&P futures? E-mini S&P Live E-Mini S&P Futures chart. Plus all major currency pairs, realtime Indices Charts, Commodities Charts, Futures Charts and more. E-mini trading involves leverage, while trading the highly volatile index futures market. This the primary arena for intraday traders. E-minis are high risk/. An E-mini is an electronically traded futures contract that is a fraction of the value of a standard futures contract. Read about E-mini investing here. Today's S&P E-Mini prices with latest S&P E-Mini charts, news and S&P E-Mini futures quotes. S&P E-Mini Quotes. Quotes are delayed, as of July 09, , PM CDT or prior. S&P E-Mini Options Spreads. Month, Last, Change, Percent, Open. S&P E-Mini Today: Get all information on the S&P E-Mini including historical chart and constituents. Interactive Chart for E-Mini S&P Sep 24 (ES=F), analyze all the data with a huge range of indicators. Carefully study how certain news events and trade dialogues create price movements around specific levels on the chart. Learn how stop losses, take profit. These are the charts our Partners use every day to trade for a living. Ordinary people doing extraordinary things with their time, lives, and money. Interactive Chart for E-Mini S&P Sep 24 (ES=F), analyze all the data with a huge range of indicators. Get the latest E-mini S&P price (ES) as well as the latest futures prices and other commodity market news at Nasdaq. This continuous historical price chart for S&P E-mini futures (ES, CME) is part of a huge collection of historical charts that covers decades of North. End of interactive chart. Build Your Watchlist. Personalize and monitor market data with your custom tool. Register Now. Advanced Charting for E-Mini S&P Future Continuous Contract (ES00) including date ranges, indicators, comparisons, trendlines and annotations. Get instant access to a live advanced chart for the S&P Index Futures CFDs. E-mini S&P futures are a mini version (1/5 th the size) of S&P futures contracts and are traded on the CME. S&P E-Mini (June ) - Chart. Commodity. Get a Chart, Corn, Oats, Soybeans, Soybean Oil, Soybean Meal, Wheat, KCBT Wheat, MGEX Wheat, Feeder Cattle, Lean. The E-mini S&P index futures contract is a tradable instrument representing of the largest stocks on the US stock exchanges. A one point move in the. Get E-mini S&P (ES) historical prices as well as the latest futures price and activity for your symbols on the My Quotes of aivixprel.online

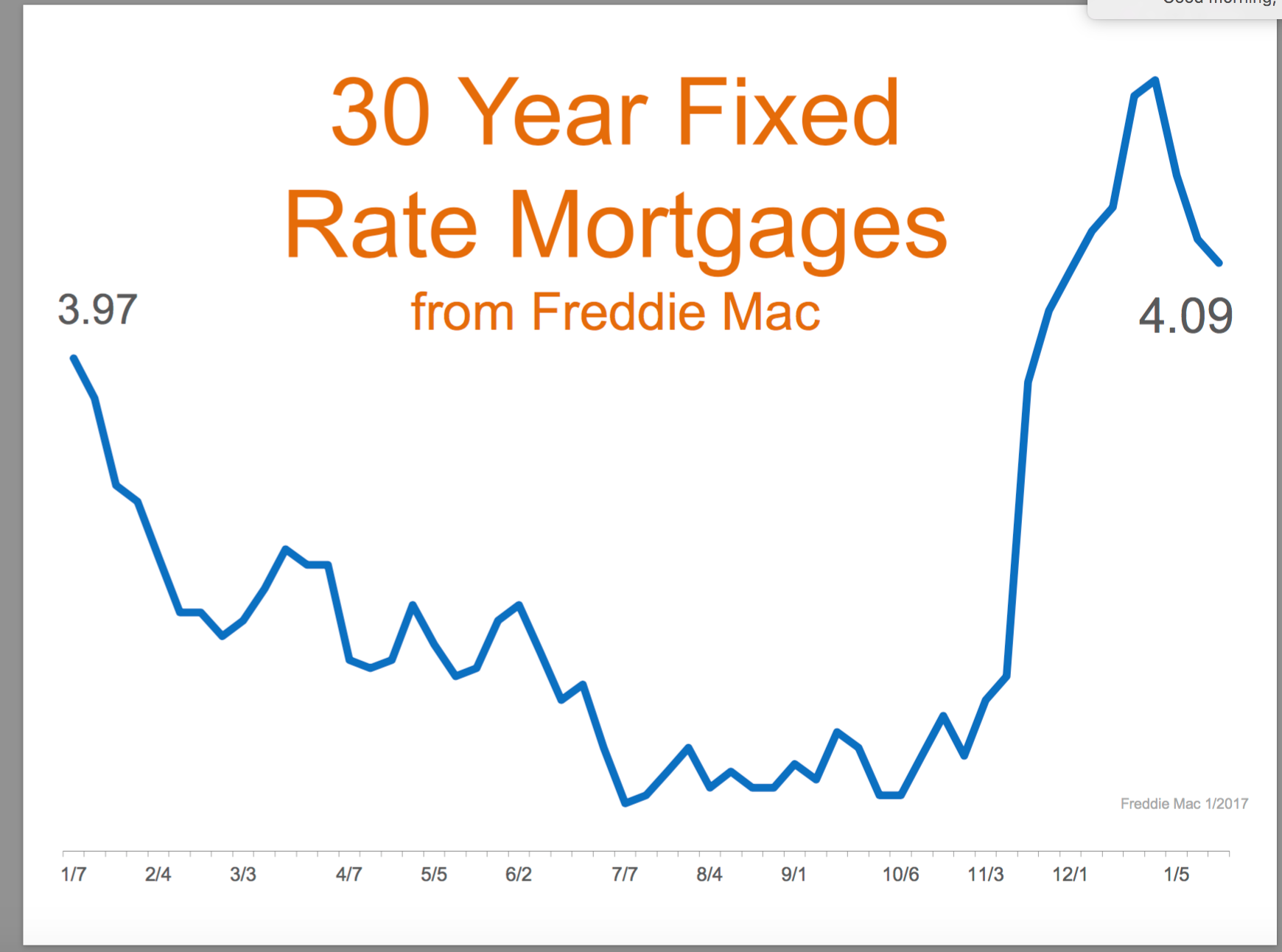

30 Year Fixed Mortgage Rate Trend Graph

The current average year fixed mortgage rate climbed 3 basis points from Adjust the graph below to see year mortgage rate trends tailored to. Mortgage Rates History. - Mortgage Rates: Recent / Median / Cumulative Average / Mode / Chart - 30 Year Fixed-Rate Mortgage All-Time High | 30 Year. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. Index performance for aivixprel.online US Home Mortgage 30 Year Fixed National Avg (ILM3NAVG) including value, chart, profile & other market data. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 3 basis points from % to % on Sunday. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since Mortgage Rates for 30 year fixed. Asking for a Trend · Opening Bid · Stocks in Translation · NEXT · Lead This Way · Good. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. The current average year fixed mortgage rate climbed 3 basis points from Adjust the graph below to see year mortgage rate trends tailored to. Mortgage Rates History. - Mortgage Rates: Recent / Median / Cumulative Average / Mode / Chart - 30 Year Fixed-Rate Mortgage All-Time High | 30 Year. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. Index performance for aivixprel.online US Home Mortgage 30 Year Fixed National Avg (ILM3NAVG) including value, chart, profile & other market data. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 3 basis points from % to % on Sunday. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since Mortgage Rates for 30 year fixed. Asking for a Trend · Opening Bid · Stocks in Translation · NEXT · Lead This Way · Good. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to.

Overview. News Ideas Minds · MORTGAGE30US chart . · Full chart. 1 year 5 years 10 years. All time. About Year Fixed Rate Mortgage Average in the United. Mortgage Rates for 30 year fixed. Asking for a Trend · Opening Bid · Stocks in Translation · NEXT · Lead This Way · Good. Compare current mortgage rates today and read daily mortgage rate news from HousingWire's award-winning newsroom. Check out this chart example made with everviz: U.S. Year Fixed Rate Mortgage Average - Line chart. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Year Fixed Rate Mortgage. (updated ). see less. Federal Reserve Bank of SELECT CHART. reset all selections. SELECT DATA. compare data series. Analyze mortgage trends for 30 year fixed, 15 year fixed & 5/1 ARM for last 30 years YearARM Mortgage Rate. Rate Table. Chart. Date, Year Today's national year mortgage interest rate trends On Sunday, September 01, , the current average interest rate for a year fixed mortgage is %. PRIMARY MORTGAGE MARKET SURVEY®. 3, Summary page with all rate types - U.S. averages. 4. 5, U.S., 30 yr, U.S., 15 yr, U.S., 5/1 ARM, U.S., 30 yr FRM/. 6, 30 yr. Check out current rates for a year conventional fixed-rate loan. These rates and APRs are current as of 08/30/ and may change at any time. They assume. Graph and download economic data for Year Fixed Rate Mortgage Average in the United States from to about year, fixed, mortgage. Year Fixed Rate Mortgage Average in the United States was % in August of , according to the United States Federal Reserve. Historically, Year. Overview. News Ideas Minds · MORTGAGE30US chart . · Full chart. 1 year 5 years 10 years. All time. About Year Fixed Rate Mortgage Average in the United. Weekly average mortgage rates since Data is provided by Freddie aivixprel.onlinet and Historical Mortgage Rates. The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. Open submenu (Charts)Charts; Open submenu (Learn About MBS)Learn About MBS Current Mortgage Rates. 30 Year Fixed Rate. % + Rate Data. Today's. Your rate will vary depending on your credit score and other details. Year Fixed Mortgage Rates Trend Graph. See how rates have changed over time. 30 Years. In May , the average mortgage rate was above 5%. While this was below historical trends, it was the highest rate since From there, the year fixed. Line graph showing last 90 days of the year fixed-rate new purchase. Mortgage Rates. Year Fixed Mortgage Rate aivixprel.online US30YFRM:Exchange. EXPORT download chart. WATCHLIST+. RT Quote | USD. Last | AM EDT. quote price arrow up + .

Car Loan Interest Rates Credit Score

Credit score—Generally, you can get a lower interest rate on your auto loan if you have a higher credit score. · Debt-to-income ratio—These numbers determine. This credit score also determines the borrower's interest rate on the loan. To secure a currently low interest rate on new car loans, lenders will often. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Personal Auto Loans (Fixed Rates). Effective 09/13/ Loan Types, 48 84 month options requires a credit score of + for all borrowers on the loan. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. ** The APR (Annual Percentage Rate) is based on credit worthiness, loan amount, current mileage, term of the loan and loan to value. A lower credit score may. Interest rates assume excellent borrower credit history. Still, like many other car loan lenders, NFCU doesn't disclose its minimum credit score requirements. Loan terms offered, including any required down payment, may be different than the lowest advertised rate based on borrower credit score, loan amount, vehicle. For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a. Credit score—Generally, you can get a lower interest rate on your auto loan if you have a higher credit score. · Debt-to-income ratio—These numbers determine. This credit score also determines the borrower's interest rate on the loan. To secure a currently low interest rate on new car loans, lenders will often. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Personal Auto Loans (Fixed Rates). Effective 09/13/ Loan Types, 48 84 month options requires a credit score of + for all borrowers on the loan. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. ** The APR (Annual Percentage Rate) is based on credit worthiness, loan amount, current mileage, term of the loan and loan to value. A lower credit score may. Interest rates assume excellent borrower credit history. Still, like many other car loan lenders, NFCU doesn't disclose its minimum credit score requirements. Loan terms offered, including any required down payment, may be different than the lowest advertised rate based on borrower credit score, loan amount, vehicle. For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a.

Average Credit Score for New Car. Annual Percentage Rate. Average Credit Score for Used Car ; %, ; %, ; %. This number determines what your car loan interest rate will be, and will also determine your eligibility for loans. So what what exactly is a credit score and. One of the ways this will impact your auto loan is the interest rate you will qualify for. Interest rates can range from % for those with excellent credit to. Stated “rates as low as % APR” apply to well-qualified applicants with credit scores of , loan terms of 36 months and vehicles with less than 80, Car Loan APRs by Credit Score As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. To get an auto loan without a high interest rate, my research shows you'll want a credit score of or above on the to point scale. These are the latest average interest rates for used cars, by credit score level, according to the Experian report. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. This auto loan tool takes into account your credit score, current interest rates, and the term length of the loan to determine how much you'll pay per month. New/Used Auto financing available up to % Loan to Value ; %, %, %, % ; %, %, %, %. IT PAYS TO HAVE A GOOD SCORE: ; $20,, 60 months, , %, $ ; $20,, 60 months, , %, $ Actual payment varies based on credit score, loan amount, term, model year, and type of vehicle. U) For the College Auto Loan, borrower must be at least Average Interest Rates for Car Loans with Bad Credit ; Prime (), %, % ; Nonprime (), %, % ; Subprime (), %, % ; Deep. 7-year auto loans, rates as low as % APR, Star One Credit Union. Rates based on credit score and applicable discounts. 2 New auto loans only How Is Interest Calculated on a Car Loan? Read More. Copyright © Loan terms offered, including any required down payment, may be different than the lowest advertised rate based on borrower credit score, loan amount, vehicle. Whether you're shopping for a new car or a used car, Consumers Credit Union has the auto loan rates and options you need to get back on the road fast.

How To Find The Best Car Insurance

Choosing the best car insurance involves comparing claims satisfaction, prices, and the services offered. View our ratings and reviews and browse our buying. Find answers to your car insurance questions, including what policy is right for you, insurance rules, and pricing. How to get the best car insurance in 5 steps · aivixprel.online the coverages you need · aivixprel.online on optional coverages · aivixprel.onlinech the financial health of several. To get car insurance for the first time, decide what coverage types and limits you need and then compare quotes from at least three different companies to find. Find out what prices and discounts your current insurance company is offering, but get actual quotes from as many other insurance companies as you can. While. The best way to shop for car insurance is to do so annually by using comparison tools located on specific websites. Car insurance rates vary by person and by company. · It is recommended to compare auto insurance quotes from different companies every six months. · The fastest. We ranked the best cheap car insurance companies to help you find an insurer that best suits your budget. Keep in mind that these are only sample annual costs. American Family is the best car insurance company when it comes to your wallet. According to our analysis, American Family's average rate for full coverage. Choosing the best car insurance involves comparing claims satisfaction, prices, and the services offered. View our ratings and reviews and browse our buying. Find answers to your car insurance questions, including what policy is right for you, insurance rules, and pricing. How to get the best car insurance in 5 steps · aivixprel.online the coverages you need · aivixprel.online on optional coverages · aivixprel.onlinech the financial health of several. To get car insurance for the first time, decide what coverage types and limits you need and then compare quotes from at least three different companies to find. Find out what prices and discounts your current insurance company is offering, but get actual quotes from as many other insurance companies as you can. While. The best way to shop for car insurance is to do so annually by using comparison tools located on specific websites. Car insurance rates vary by person and by company. · It is recommended to compare auto insurance quotes from different companies every six months. · The fastest. We ranked the best cheap car insurance companies to help you find an insurer that best suits your budget. Keep in mind that these are only sample annual costs. American Family is the best car insurance company when it comes to your wallet. According to our analysis, American Family's average rate for full coverage.

How to compare car insurance quotes · 1. Know your state limits. Nearly every state requires some form of auto insurance. · 2. Gather your info. Finding the best. The best way to find savings is by comparing auto insurance rates from multiple carriers. But that can get overwhelming fast, especially if you have a less than. Experian suggests finding the right balance with as much coverage as you can afford comfortably. When deciding which coverages and amounts are best for you. When comparing car insurance quotes, there are a few key factors to consider. First, you'll want to make sure that each quote includes the coverage and benefits. Use an independent agency that can represent dozens of insurance companies and will research the best policies for you. I have used the same. You can do a few things to help make car insurance rates more affordable after a ticket. One is to look for discounts. Taking defensive driving or safe driving. The best way to find affordable car insurance is to compare quotes from multiple car insurance companies. MoneyGeek dug into the data to analyze the. The best car insurance for you will depend on several factors, including your driving record, age and the area where you live. We analyzed rates, satisfaction. Narrow down top auto insurance companies by gap insurance, homeowner discount and more to find the best for your budget and financial goals. Compare the best car insurance rates in three steps: · Quote with Progressive · Compare rates from other companies · Save on your car insurance. HOWEVER, you could also go to specific insurance websites (progressive, geico, state farm, etc) and fill out a quote AS ACCURATE AS POSSIBLE. Find out if you're overpaying. We shop and compare quotes for you from over 40 top insurers ; Get notified when rates in your area drop. Know when it's a good. Moral of the story: The cheapest insurance can come at a high price if you're in an accident. So make sure you choose a good, reputable car insurance company. How to compare car insurance quotes. · Coverages: Although some are required, make sure you pick the same coverages for each quote. · Policy limits: There are. Insurance companies calculate premiums based on a variety of factors, including age, ZIP code, and driving record. As a result, it's a good idea to get quotes. Experian suggests finding the right balance with as much coverage as you can afford comfortably. When deciding which coverages and amounts are best for you. To compare car insurance quotes effectively, you'll want to gather quotes from multiple insurers with similar coverage levels and deductibles that meet your. aivixprel.online is one of the best car insurance comparison sites. aivixprel.online is a free insurance comparison website that offers drivers across the country real-time. How to Lower Your Car Insurance Rate · Combine auto and home policies: · Review your limits and deductibles: · Update your policy information regularly: · Pay for.

Single Filing Tax Brackets

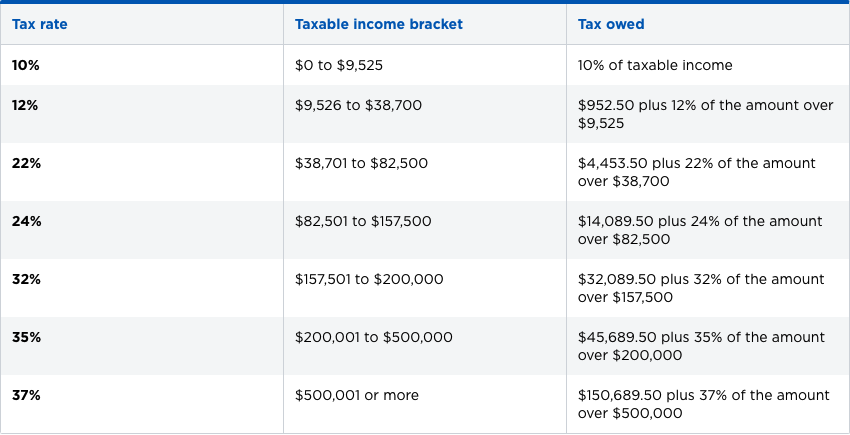

Schedule X—Use if your filing status is Single. · $11, · 11, ; Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, tax brackets ; 22%, $47, to $,, $94, to $, ; 24%, $, to $,, $, to $, ; 32%, $, to $,, $, to. Marginal tax rate: Your tax bracket explained ; Single Filing Status ; Income, Tax Bracket ; $11,, 10% ; $44,, 12% ; $95,, 22%. California tax brackets for Single and Married Filing Separately (MFS) taxpayers ; Taxable Income. Rate ; $0 – $10, % ; $10, – $24, % ; $24, –. federal income taxes paid by individual taxpayers. Rate. Single persons with adjusted gross income of $4,, head of family with adjusted gross income of. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. For example, for the tax year, the 22% tax bracket range for single filers is $47, to $,, while the same rate applies to head-of-household filers. Schedule X—Use if your filing status is Single. · $11, · 11, ; Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, tax brackets ; 22%, $47, to $,, $94, to $, ; 24%, $, to $,, $, to $, ; 32%, $, to $,, $, to. Marginal tax rate: Your tax bracket explained ; Single Filing Status ; Income, Tax Bracket ; $11,, 10% ; $44,, 12% ; $95,, 22%. California tax brackets for Single and Married Filing Separately (MFS) taxpayers ; Taxable Income. Rate ; $0 – $10, % ; $10, – $24, % ; $24, –. federal income taxes paid by individual taxpayers. Rate. Single persons with adjusted gross income of $4,, head of family with adjusted gross income of. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. For example, for the tax year, the 22% tax bracket range for single filers is $47, to $,, while the same rate applies to head-of-household filers.

Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, Paying Tax Owed · Amend a Return · Property Tax Credit · Personal Income Tax · Tax Rate Schedules and Tables · Filing Status · Taxable Income · Tax Credits and. HIGHLIGHTS · Arizona Standard Deduction Amounts Adjusted · New Tax Rate of % for All Income Levels and Filing Status. Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. In , the top tax rate of 37% applies to those earning over $, for individual single filers, up from $, last year. Meanwhile, the lowest. The first $17, of their total taxable income is then taxed at the lower rates, with the remainder being subject to tax at the rate of %. If a couple. The chart shown below outlining the Maryland income tax rates and brackets is for illustrative purposes only. Individual Income Tax Filings and Payments. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; 1, $,, $, ; 2, $2,, $4, Historical Tax Tables may be found within the Individual Income Tax Booklets Note: The tax table is not exact and may cause the amounts on the return to be. Federal Taxes ; 10%. $0. $0 ; 12%. $10, $20, ; 22%. $41, $83, ; 24%. $89, $, ; 32%. $, $, Maryland Income Tax Rates. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries, Taxpayers Filing Joint Returns, Head. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Below are the tax rates. For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Filing & Paying Your Taxes · Payment Options If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows. file a federal income tax return must file a Louisiana Individual Income Tax Return. Rate of tax. Effective January 1, , Effective January 1, Federal Income Tax Brackets and Tax Rates for ; Tax Rate, For Single Filers, For Married Couples Filing Jointly ; 10%, $11, or less, $23, or less ; 12%. Tax Rate Changes – Indexed for Inflation ; If the Missouri taxable income is The tax is ; $0 to $1,, $0 ; Over $1, but not over $2,, % of excess. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. Schedule time to focus on your tax information. Our SC Instructions packet provides detailed information for filing your Individual Income Tax return. There is no tax schedule for Mississippi income taxes. The graduated Individual Income Tax Notices · Frequently Asked Questions · Tax Forms and.